Back to Business

Looking back over the past year, the investment world hit peak uncertainty in the second quarter of 2020, shortly after COVID-19 was declared a pandemic and the world went into lockdown. Even though COVID-19 is not yet in the rearview mirror and important questions around vaccine distribution and fiscal policy responses in many countries have yet to be settled, MicroVest is cautiously optimistic that the markets in which we invest are normalizing with downstream impact on our own approaches to investment and portfolio management processes.

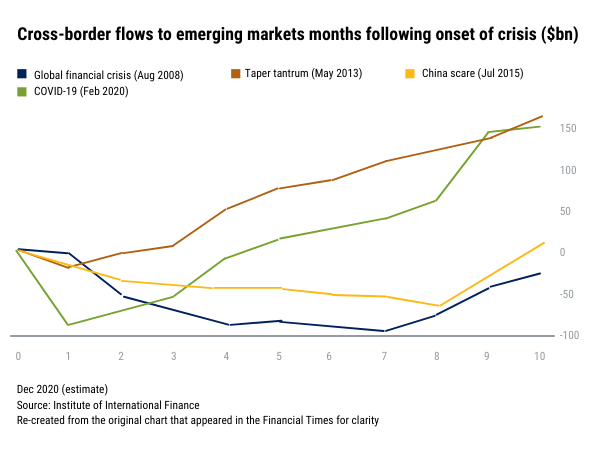

The chart below puts emerging market capital flows in the wake of COVID-19’s onset into historical perspective. Compared to other historical crises, such as the first months of the Global Financial Crisis in summer 2008 and the Taper Tantrum in May 2013, net capital inflows to emerging markets have rebounded significantly after a brief but steep dive in those chaotic and uncertain early days of the pandemic. While the drop was dramatic and unprecedented ($243bn in the first four months of 2020 – $95bn in March alone), so too was the rebound in capital flows in the second half of 2020, with $145bn of inflows in November 2020 alone.

This rebound underpins an optimistic approach for investments in 2021, and this view is supported when we look across the economic, fiscal and health trends in the markets where we invest.

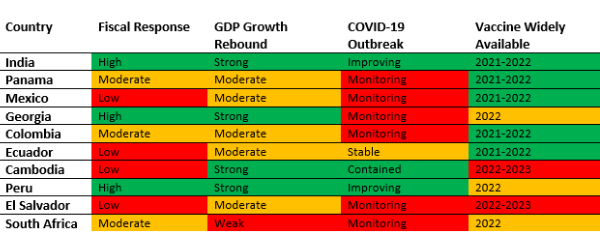

The table below captures our Risk Team’s assessment as of January 2021, of the top 10 countries represented in our portfolio by assets invested. In addition to analyzing the trend of COVID-19 outbreaks and our views regarding the widespread availability of a vaccine, we also consider whether the economy is recovering and the quality of government fiscal policy measures to stimulate aggregate demand and provide relief to vulnerable members of society.

Take the example of India, a country where MicroVest has historically had the largest investment allocation, which has a broadly positive post COVID-19 recovery outlook. While COVID-19 cases were still registering over 125k new cases per week in early January 2021, the trend is improving, and the Indian government has introduced fiscal stimulus measures totaling 7.5% of GDP while monetary authorities have cut benchmark interest rates. As a result, India’s GDP growth for the following year is expected to rebound to high single digit levels.

Even in several markets where health data remains challenged (Latin America and South Africa), many countries do have countervailing bright spots. Several emerging market countries provided fiscal support during COVID-19, mostly through deficit spending or re-allocating resources towards pandemic responses. While we do need to closely monitor debt-to-GDP ratios in the medium-to-long term, the aftermath of the Global Financial Crisis of 2008-2009 underscored how overly focusing on deficit control can be at odds with a broad and sustained recovery. Despite several countries where the positive appears to outweigh the negative, our risk framework has flagged a few countries, notably El Salvador and South Africa, where health data remains challenged and the vaccine may not arrive until 2022 or 2023.

Increasing demand for capital among Responsible Financial Institutions (RFIs) in 2021 combined with stable assets across Microfinance Investment Vehicles (MIV) should support continued normalization in the year to come. We expect a rebound in economic growth across many of our core markets to translate into high demand for financing from the individuals and small businesses that our RFIs support. RFIs that preserved liquidity and focused on portfolio quality in 2020 are now resuming lending, taking advantage of pent-up demand from reduced lending activity in 2020.

DISCLOSURE INFORMATION

The information contained in this communication has been provided by MicroVest Capital Management, LLC (“MicroVest”) and no representation or warranty, expressed or implied is made by MicroVest as to the accuracy or completeness of the information contained herein. Any forward-looking statements contained herein with respect to MicroVest’s plans and strategies, anticipated capital investments, changes in market conditions, financial projections or any other matters that are not historical facts, are only predictions and estimates regarding future events and circumstances. Market conditions and MicroVest’s actual results may differ materially from the market conditions and results discussed in these statements.