Gradual normalization and subsequent increased demand in 2021 outweighs short term health challenges

Despite public health challenges caused by a new wave of COVID-19 in several countries, the MicroVest team continues to witness a process of adaptation and gradual normalization in many markets where our portfolio of Microfinance and SME Finance Institutions operate. The numbers support this claim, as total annual asset growth of MicroVest’s portfolio of Microfinance and SME Finance Institutions across all managed funds remained strong at approximately 11%1 in 2020, despite pandemic effects.

The adaptation measures employed by our portfolio of Microfinance and SME Finance Institutions – both from an operational and underwriting standpoint — have been remarkable. At the same time, Governments and Regulatory Bodies have learned from the early days of the pandemic over a year ago. As a result, the overall policy environment remains supportive, as fiscal measures, accommodative monetary policy and flexibility from Banking Regulators are all contributing to a stable demand for financing from these Institutions in the markets where we invest.

While our investment and risk management teams are continuing to monitor the COVID-19 response in all our markets, we have been keeping a particularly close eye on India and Myanmar; two countries that have experienced adverse health and political developments over the last quarter.

India – Despite health challenges, long-term fundamentals for Micro and SME finance remains strong

India experienced an unprecedented upsurge in COVID-19 infections in April 2021, with high mortality rates creating a significant burden on the country’s healthcare system. However, nationwide lockdowns have not yet been implemented, and while many economic activities are severely impacted, the microentrepreneurs and small businesses that MicroVest indirectly serves are often essential businesses in their communities. As a result, with what we currently know, our team does not foresee any long-term deterioration of portfolio quality among the Responsible Financial Institutions (RFIs) in our portfolio.

India is MicroVest’s largest country exposure, and despite recent challenges posed by COVID-19, we still have high confidence in the long-term strengths of both the country and the sector. In a time when the facts on the ground are admittedly challenging, it is worth stepping back and revisiting the core principals of our investment thesis in India.

By investing in India, we are participating in a country with young demographics and significant economic potential. Regardless of the ruling party in power, emphasis on Financial Inclusion is a strong feature of India’s public policy and has only intensified with the advent of the digital economy. Those familiar with India will recall the policy of Priority Sector Lending, which requires domestic banks to channel about 30% of financing to sectors that fall under priority sectors such as Financial Inclusion. The Policy has been in place for last few decades and is a strong foundation for the microfinance and small business sector overall. Moreover, our borrowers in India are supervised by a regulator that is supportive but prudent. The Reserve Bank of India (RBI), a highly respected regulator, has implemented rules such as limits on loan sizes and limits on margins to prevent lending excesses. For our part, we have allocated investment to the best-in class RFIs with the knowledge that crises will come even if we cannot predict exactly when they will happen or what they will look like. With international funding by Microfinance Investment Vehicles (MIVs) like MicroVest locked up for a minimum of three years, the RBI deters counter cyclical capital flight to preserve funding in times when it is most necessary. This is also not the first shock to the Indian financial sector that MicroVest has had to navigate through in recent years. We were able to steer our overall portfolio through events like the demonization crisis of 2017-2018, the short-term liquidity crisis caused by the default of a large domestic lender in 2018 and the first wave of COVID-19 over one year ago.

Myanmar – Microfinance Institutions continue to operate on a limited basis

The military coup in Myanmar in February 2021 resulted in political violence between Military and Pro-Democracy protesters. The unstable situation on the ground caused temporary closure of businesses and the interruption of banking services. There are still operational challenges for Microfinance Institutions who continue to operate on a limited basis. While the political situation in Myanmar continues to develop, MicroVest is monitoring the situation closely and may need to offer forbearance depending on how the situation progresses over the rest of 2021. We do not expect that the situation will materially impact our overall portfolio due to our limited exposure to the country.

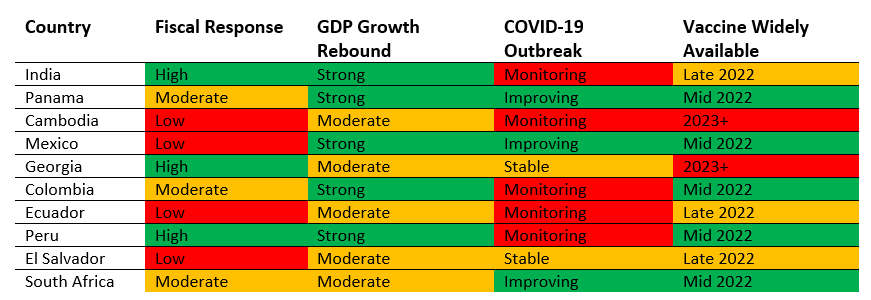

The table below captures our Risk Team’s assessment as of May 2021, of the top 10 countries represented in our portfolio by assets invested. In addition to analyzing the trend of COVID-19 outbreaks and our views regarding the widespread availability of a vaccine, we also consider whether the economy is recovering and the quality of government fiscal policy measures to stimulate aggregate demand and provide relief to vulnerable members of society.

Looking Ahead In the United States, vaccines are now widely available, but the same cannot be said about most of the markets in which we invest. While we are carefully monitoring the situation, we are mindful of several key strengths that broadly define our markets. First, local liquidity remains strong, with lending operations both on collections and disbursements continuing at much higher levels than what we observed in 2020 on average. Second, emerging market growth projections remain robust, which points towards a high demand for financing in local economies in 2021. Third, microfinance and small business borrowers are resilient and value the services offered by the RFIs in our portfolio.

1 Based on self-reported data from MicroVest portfolio companies across all funds in 2020.

DISCLOSURE INFORMATION

The information contained in this communication has been provided by MicroVest Capital Management, LLC (“MicroVest”) and no representation or warranty, expressed or implied is made by MicroVest as to the accuracy or completeness of the information contained herein. Any forward-looking statements contained herein with respect to MicroVest’s plans and strategies, anticipated capital investments, changes in market conditions, financial projections or any other matters that are not historical facts, are only predictions and estimates regarding future events and circumstances. Market conditions and MicroVest’s actual results may differ materially from the market conditions and results discussed in these statements.