Economies growing and credit demand increasing

Authored by Leela Vosko

Global Outlook

As the second month of 2022 draws to a close and we pass two full years of living with COVID-19, MicroVest has positioned itself to thrive in the challenging environment that continues to define emerging markets investing. While the financial press has expressed concern about the macro-level health of emerging markets overall, our team continues to focus on the fundamentals of credit investing and sees exciting investment opportunities in responsible microfinance and SME finance institutions with whom we have robust analytics on and longstanding relationships with.

As we look towards the rest of 2022, there are many persistent uncertainties, such as the return of inflation in the developed markets and anticipated actions by the U.S. Federal Reserve. The geopolitical landscape also remains challenging, and while MicroVest does not have any investments in Russia or Ukraine, it is too early to tell whether an escalation of hostilities could destabilize the region and give investors another reason to lower their risk appetite for emerging markets. Some worry that capital will migrate out of emerging markets as the developed world’s economic growth rate increases due to the COVID-19 recovery, as well as the impact of inflation on GDP growth. While we do expect capital to return to the U.S. with higher interest rates, broadly speaking emerging markets are less dependent on foreign capital than in the past. Large players like Brazil, India, and South Africa are all maintaining high levels of foreign reserves and retain access to local capital markets. While selected frontier markets may come under more stress, our bottom-up research and portfolio monitoring process already takes these concerns into account in our underwriting and investment allocation.

Demand Outlook

While none of us can be certain about how any of these events will play out, we can only point to 2021 as a case study in how our team and our portfolio of Responsible Financial Institutions (RFIs) successfully navigated uncertainty. Having learned from the first wave of COVID-19 in March 2020, MicroVest’s portfolio companies were better prepared in 2021 for surges in COVID-19 cases due to the Delta and Omicron variants. During 2021, only three of MicroVest’s portfolio companies needed forbearance as compared to 12 during 2020. Most of these companies scaled back their borrowing needs in reaction to local credit demand as the Delta variant hit in mid-2021. By Q4 2021, most RFIs had resumed lending activity, while the three RFIs requiring forbearance in 2021 made partial payments to principal balances outstanding. With the Omicron variant proving less disruptive than Delta, economies are growing once again, supporting persistently resilient demand for credit.

Yield Outlook

During 2022, we are beginning to see rising yields in new pipeline transactions due to a combination of factors. Though the Federal Reserve has not acted yet to lift rates in the U.S., inflation is increasing, and most credible market forecasts indicate that monetary policy tightening may begin as soon as March 2022, although there is divergence of opinions regarding the number and pace of interest rate rises. The combination of a rising interest rate environment and increasing local credit demand mark a reversal from 2021. As rates rise and RFIs continue to show a robust demand for capital, MicroVest is having some initial success pricing transactions at slightly higher yields than we would have anticipated in 2021. We view this as a net positive as we look to deploy additional capital in 2022.

Risk Outlook

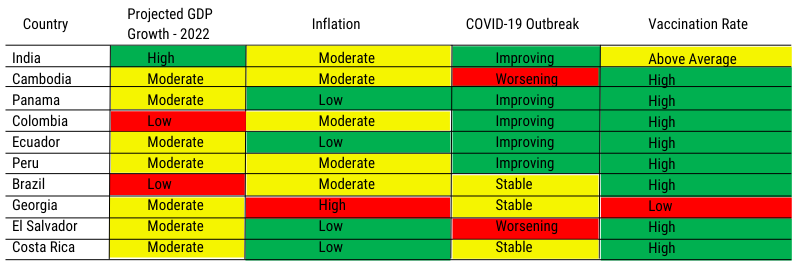

The table below captures our Risk Team’s assessment as of February 2022, of the top 10 countries represented in our portfolio by assets invested. These assessments are based on analyzing the trend of COVID-19 outbreaks and vaccination rate, as well as whether the economy is recovering, inflation, and projected GDP growth.

After several years of focusing predominantly on our existing RFI relationships, MicroVest is looking to selectively add new borrowers to the portfolio in 2022. We continue to operate efficient due diligence and risk management processes. As of early 2022, MicroVest has $170 million of investment pipeline with the possibility for upside since a portion of our portfolio companies have capacity for additional growth. While it is always prudent to be cautious in the face of macroeconomic and geopolitical forces beyond our control, we are very excited about the opportunities to continue investing in RFIs and their respective missions. Below, we have showcased two countries where we see opportunity.

India

India continues to be one of our top performing countries and our largest exposure. Some forecasters expect a second year of strong GDP growth for 2022 at 7% as India recovers from COVID-19, and although there may be some risk that this growth is more modest, it would still put India among one of the fastest growing economies in the world. While inflation was elevated and will likely prompt the Reserve Bank of India to start lifting rates, food prices, which account for almost half of the consumer price basket, remained largely stable in the second half of 2021. National priorities include infrastructure investments and enhancing the digital economy to raise the country’s long-run growth potential. In the FY 2022-2023 Union Budget, the government has de-emphasized support for social welfare and the rural economy, which rely on private finance to fill the gap.

Cambodia

Cambodia has been one of the exceptions in how they’ve managed the pandemic. After a nationwide campaign aimed at addressing COVID-19, Cambodia now boasts one of the world’s highest vaccination rates, at 83% as of March 2022. Cambodia also reopened for fully vaccinated tourists from overseas without quarantine in November 2021, a move that is expected to boost the country’s economy and provide a resurgence of jobs.

Despite this, there has been a rebound of COVID-19 cases, which has slowed recovery, especially in the services, food, transportation, construction, and real estate sectors. Forecasters expect recovery in economic growth from less than 2% in 2021 to over 5% in 2022, assuming there is no fresh outbreak of COVID-19.

DISCLOSURE INFORMATION

The information contained in this communication has been provided by MicroVest Capital Management, LLC (“MicroVest”) and no representation or warranty, expressed or implied is made by MicroVest as to the accuracy or completeness of the information contained herein. Any forward-looking statements contained herein with respect to MicroVest’s plans and strategies, anticipated capital investments, changes in market conditions, financial projections or any other matters that are not historical facts, are only predictions and estimates regarding future events and circumstances. Market conditions and MicroVest’s actual results may differ materially from the market conditions and results discussed in these statements.