Authored by Leela Vosko

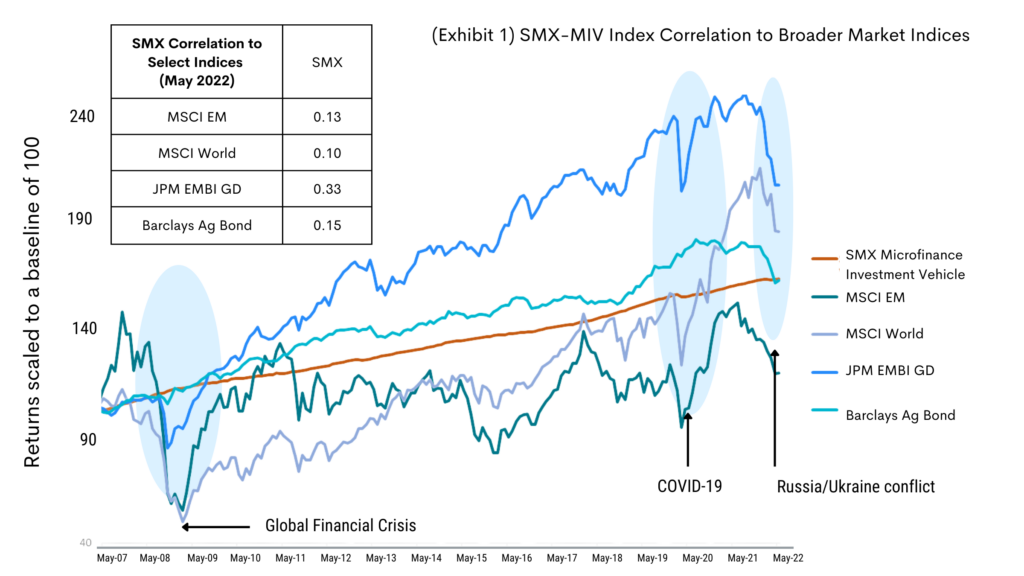

In the past several months, accelerating inflation has caught central banks by surprise and pushed the Federal Reserve to start increasing its benchmark interest rates. While global economic turmoil and third order effects of the war in Ukraine left few portfolios unscathed, an entire asset class of Micro- and SME Finance-focused emerging markets private debt proved remarkably stable (Exhibit 1). As traditional asset classes experienced volatility during the most recent period of turbulence and throughout major crises of the past, the Symbiotics Microfinance Index (SMX-MIV),1 which tracks the monthly performance of Microfinance Investment Vehicles (MIVs) whose assets are invested in fixed-income instruments, continued generating steady returns while exhibiting low correlation with broader market indices.

What is Microfinance Private Debt?

The premise is straightforward. Asset managers invest in responsible Microfinance and SME Financial Institutions in emerging markets who then provide capital to underserved microentrepreneurs and SMEs in their local economies. The MSMEs use these borrowed funds for productive purposes to grow their already existing businesses, such as the acquisition of equipment and machinery or for working capital such as inventory purchases. The consistency of performance is driven by the continuous productivity gains of these borrowers who are highly motivated to repay their loans as they continue to grow and reinvest in their small businesses. See examples of use cases.

What drives the asset class’s low correlation to other major indices?

1) Hyper-diversification across geography;

2) The underserved end borrower as its own form of diversification;

3) Indirect access to a diverse pool of private companies

Hyper-Diversification Across Geography

As Exhibit 1 shows, emerging market stocks have tended to track the movements of major indices while SMX exhibits a correlation that has been low to negative. Often, the same investors who buy developed market stocks are also allocating to emerging market equities as a diversification strategy.

However, microfinance debt puts investors’ money to work in more emerging and frontier markets while emerging markets equities tend to cluster in fewer markets with large populations and liquid, local equity markets, such as Brazil, China and India. In some cases, index providers even classify advanced economies like South Korea as an emerging market. As a result, the universe of publicly-traded stocks that carry an emerging markets designation continues to be concentrated.

In a typical emerging markets ETF or index fund, a small number of stocks may disproportionately drive performance of the entire fund. For example, the Vanguard FTSE Emerging Markets ETF, which is among the largest emerging markets ETFs by assets, has 32.1% of assets invested in China-based companies.2 With large cap companies in several major countries dominating a typical emerging markets index, there is greater chance that overall performance may be linked to global sentiment on particular industries, economic outlook or geopolitics, all of which tends to increase correlation with mainstream equity and bond market performance.

In contrast, an average portfolio of Microfinance and SME Funds often diversifies investments across more than 25 countries that range significantly from BRIC members to frontier markets. Even within a particular country, the Microfinance and SME Financial Institutions and their borrowers are often located across small cities or rural areas, further insulating the portfolio from the fluctuations of the global stock market.

Because private debt has a set maturity schedule, investors have greater certainty about the timing of their exit and can afford to invest in smaller countries where private equity and venture capital investors would struggle to find investment opportunities. Since many of the communities that MicroVest serves often have significant unmet needs for capital, it is possible to deploy additional capital into various Microfinance and SME Financial Institutions provided the investment still fits within our portfolio risk parameters.

The Underserved End Borrower as its Own Form of Diversification

MicroVest’s thesis, and that of the overall microfinance sector, is that major financial institutions in developing countries (and those most likely to be listed on stock exchanges) fail to serve the Microentrepreneur and SME sector, because distribution and underwriting are too expensive. By providing loans to responsible Microfinance and SME Financial Institutions who focus on these segments, MicroVest’s investors are ultimately investing in businesses that are interwoven into the fabric of their local economies but have historically been unable to access credit from the formal financial sector.

Microentrepreneurs and SMEs operate in deep and diverse sectors like services (hairdressers, transportation, repairs), light manufacturing (clothing, furniture, construction), distribution and commerce (shops and wholesale), operations with local export supply chain linkages (manufacturer of crates for a local Coke bottler, for example), and leasing. Many of these businesses are resilient to local economic conditions and global macroeconomic volatility and play a vital role in local supply chains that keep communities functioning. These borrowers also exhibit low default rates,3 which drives steady returns across economic and market cycles. Even during COVID, MicroVest’s portfolio of Microfinance and SME Financial Institutions proved resilient, as our portfolio of Financial Institutions quickly adapted to changing local dynamics and found new ways to sustain their lending portfolios. In fact, halfway into 2021, despite the world still feeling the effects of the pandemic, the weighted average gross loan portfolio of Microfinance and SME Financial Institutions in MicroVest’s two flagship funds grew 12%.4

Indirect Access to a Diverse Pool of Private Companies

Through owning a portfolio of loans to Microfinance and SME Financial Institutions, investors are able to get indirect access to private companies that they could not otherwise underwrite and invest in directly. Because our investee financial institutions sit as intermediaries between MicroVest and any individual end borrower, MicroVest is only exposed to the credit risk of the overall institution, which maintains a diversified portfolio of loans to mitigate the risk that any one end borrower defaults. This structure provides strong diversification benefits to our investors.

Looking at the big picture, the Microfinance Private Debt asset class has an important role to play in the post-COVID recovery and providing access to financing for underserved segments. The SME finance gap in emerging markets remains very large, which leaves no shortage of opportunity to deploy capital. Furthermore, because end borrowers will continue to play foundational roles in the economies of their communities and remain very good credit risks regardless of global macroeconomic forces, we expect microfinance to continue serving as a key portfolio stabilizer and diversifier in any investors’ portfolio construction.

FOOTNOTES

1The SMX-MIV Debt Index tracks the monthly performance of microfinance investment vehicles (MIVs), most of whose assets are invested in fixed-income instruments. The SMX-MIV returns are net of fees and expenses. Past performance is not indicative of future returns. Investors’ performance will vary depending on individual dates of admission. There can be no assurance that the Funds’ investment objectives will be achieved or that its historical performance is indicative of the performance it will achieve in the future. To learn more please visit: https://my.syminvest.com/microfinance-investment-vehicle/symbiotics-microfinance-indexes

2 Vanguard Emerging Markets Stock Index Fund – Semiannual Report (April 30, 2022) https://investor.vanguard.com/investment-products/etfs/profile/vwo#fund-management

3 https://symbioticsgroup.com/wp-content/uploads/2015/08/Microfinance_Investment_Book_web.pdf

4 https://microvestfund.com/wp-content/uploads/2021/12/2021-MicroVest-Impact-Report.pdf

DISCLOSURE INFORMATION

The information contained in this document has been provided by MicroVest Capital Management LLC (“MicroVest”) and no representation or warranty, expressed or implied is made by MicroVest as to the accuracy or completeness of the information contained herein. This document is for informational purposes only and is neither an offer to sell nor a solicitation of an offer to purchase an interest in any MicroVest product (the “Funds”), and nothing herein should be construed as such. Any such offer or solicitation will be made only by means of delivery of a definitive private offering memorandum which contains a description of the significant risks involved in such an investment. Prospective investors should request a copy of the relevant Memorandum and review all offering materials carefully prior to making an investment. Any investment in a MicroVest product is speculative, involves a high degree of risk and is illiquid. An investor could lose all, a significant portion or some amount of its investment. You should not construe the contents of the enclosed materials as legal, tax, investment or other advice. To invest with MicroVest, one must be a qualified purchaser and an accredited investor. The investments may be deemed to be highly speculative investments and are not intended as a complete investment program. They are designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment in the Funds and who have a limited need for liquidity in their investment. There can be no assurance that the Funds will achieve their investment objectives.